MobileMuneem ã Best Microfinance App in India

Smart Android Loan Management App for NBFCs, MFIs & Cooperative Societies

Are you a Microfinance Institution (MFI), NBFC, or Credit Cooperative struggling with manual record-keeping and scattered loan data?

Meet MobileMuneem ã Indiaãs Best Microfinance Android Application designed to simplify your lending process, automate EMI tracking, and manage borrowers anytime, anywhere.

With MobileMuneem your entire microfinance operation fits right in your smartphone ã empowering field officers, branches, and your admin team with real-time access to every financial record.

Why MobileMuneem as your Microfinance Application?

MobileMuneem = Smart Lending + Easy Management + Digital Empowerment

Itãs not just an app ã itãs your complete microfinance partner in the palm of your hand.

Made for Indian Microfinance Operations

MobileMuneem is designed exclusively for the Indian lending and microfinance industry, offering full flexibility to manage various loan types ã including individual loans, group loans, product loans and other customized lending schemes.

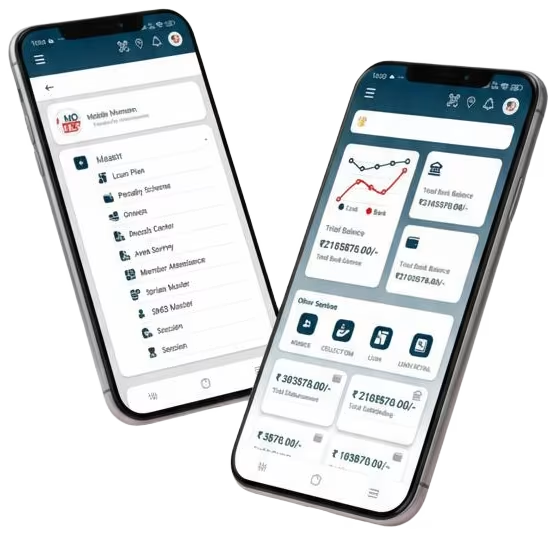

Mobile-First, Field-Ready Design

Your staff doesnãt need laptops or complex systems. With MobileMuneem , every loan officer or field collector can handle loan applications, EMI collections and customer verifications directly from their Android phone ã even in remote or rural areas.

Digital KYC & Paperless Operation

Say goodbye to bulky files and manual registers!

Upload Aadhaar, PAN, voter ID, photos and agreements directly from your mobile app. MobileMuneem helps you go 100% paperless while staying compliant.

24/7 SMS & WhatsApp Support

Stay connected with your borrowers anytime, anywhere. Send automated SMS and WhatsApp messages for loan disbursements, due date reminders, collection alerts and receipts. Borrowers always get messages on time, so they donãt forget their payments.

Complete Loan Lifecycle Management

From loan creation, approval, disbursement, EMI tracking, to closing everything happens in one place. No more juggling between spreadsheets, paper files or multiple apps.

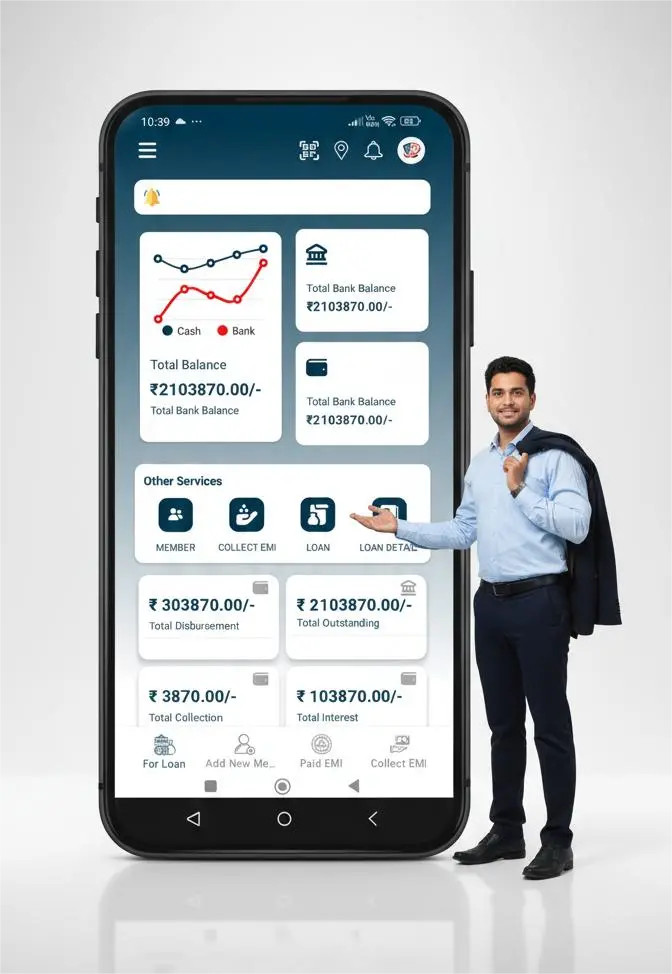

Smart Reports & Analytics

MobileMuneemãs Smart Reports & Analytics feature gives you a complete overview of your financial performance ã from total disbursements and EMI collections to overdue accounts and profitability reports.

Features

Powerful Solutions for Your Lending Business

MobileMuneem offers everything you need to run a successful microfinance or lending operation ã fast, secure, and easy to use.

From loan disbursement to EMI collection and reporting, every feature is designed to help you save time and grow faster.

-

Smart Loan Management

Easily manage individual, group, and product loans with custom EMI cycles ã daily, weekly, bi-weekly, half-monthly, or monthly.

Handle everything from loan approval to repayment tracking, penalty calculation, and report generation ã all from your mobile. -

Unique & Minimal Design

Simplicity meets power.

MobileMuneemãs minimalist layout helps users focus on what matters most ã managing loans efficiently.

No clutter, no confusion ã just a streamlined interface built to handle complex operations with ease.

Advanced Features

ABOUT MICROFINANCE

APPLICATION

Why MobileMuneem As Loan Management APPLICATION?

- Loan Creation & Disbursement

- EMI & Repayment Tracking

- Member & Group Management

- Digital KYC Uploads

- Easy Accounting

- Automatic Interest & EMI Calculation

- Loan Transfer

- Reports & Analytics

-

and much moreãÎ.

Process

How to use MobileMuneem Microfinance Application?

MobileMuneem is designed to simplify every step of your lending process ã from onboarding to loan closure.

Follow these simple steps to get started and streamline your microfinance operations:

-

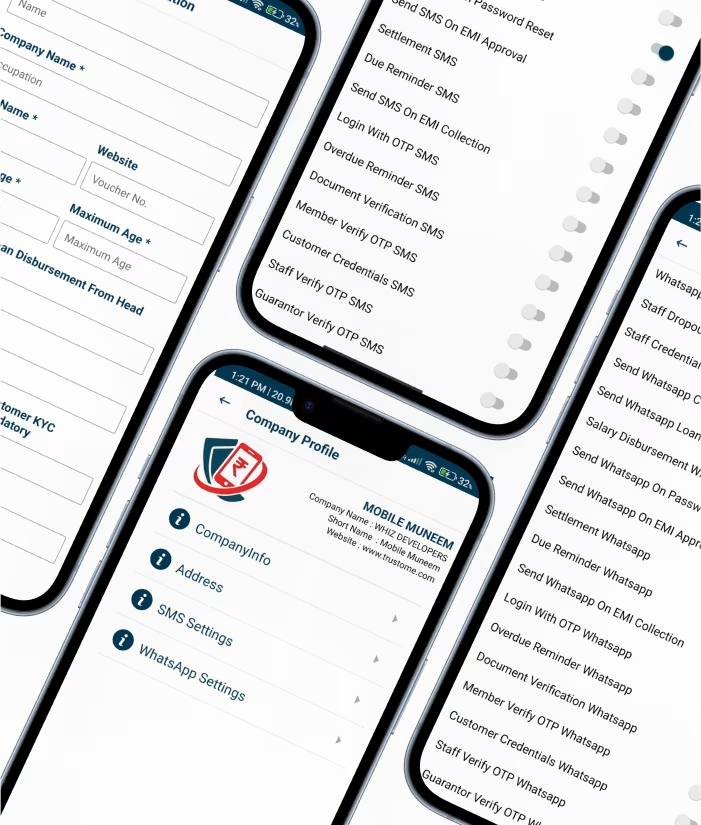

Step 1

Set Company Profile

Begin by creating your company or branch profile. Enter organization details, contact info, and set up your branding (logo, name, address and other information). Software.

-

Step 2

SMS & WhatsApp Notification Setting

Stay connected with borrowers through automated SMS and WhatsApp alerts. Send instant payment reminders, EMI due notifications, loan approval messages, and collection receipts directly from the app ã ensuring better communication and on-time repayments.

-

Step 3

Create Staff Roles & Set Role Permissions

Define roles such as Admin, Branch Manager, Field Officer, or Accountant. Assign specific permissions and access levels to ensure secure and controlled operations.

-

Step 4

Add Staff

Add your team members under each role. Each user gets secure login credentials and access according to their assigned permissions.

-

Step 5

Add Loan Plan

Set up different loan schemes with customizable parameters ã like interest rate, tenure, EMI frequency, processing fee, and penalty settings.

-

Step 6

Add Customer & KYC

Register customers by filling in personal details and uploading KYC documents such as Aadhaar, PAN, or Voter ID. Keep all borrower data digitally organized and easily searchable.

-

Step 7

Create Loan & Disbursement

Approve and disburse loans in just a few taps. The app automatically records the disbursement amount, date, and transaction mode for accurate tracking. MobileMuneem automatically generates EMI schedules based on the loan plan. Easily record daily, weekly, bi-weekly, half-monthly, or monthly collections ã even in offline mode.

-

Step 8

Print Formats (NOC, Loan Agreement, etc.)

Instantly generate and print essential documents ã including Loan Agreement, NOC, EMI Card, and Settlement Receipts ã directly from the app.

-

Step 9

Loan Reports

Access real-time reports on active loans, overdue accounts, collection summaries, and profit analysis. Stay in control with data-driven insights.

-

Step 10

Loan Close / Settlement

Mark loans as closed or settled once repayments are completed. The system automatically calculates the balance and generates closure reports.

Testimonial

WHAT CLIENTS SAY ABOUT US

Best Microfinance Loan Management Application

Let's Try! Get Free Support

Start Your 7-Day Free Trial

Free Microfinance Software Demo